Calculating Group Term Life

This article will provide a step by step outline on how to calculate Group Term Life.

OVERVIEW

Group Term Life (GTL) insurance is a common benefit provided by employers, where one contract is issued to cover multiple employees. When employer-paid life insurance coverage exceeds $50,000, employees must include the benefit value for excess coverage in their taxable wages as imputed income. If the employee pays a portion of the premium, the amount can be subtracted from the imputed income.

The benefit value of Group Term Life coverage is subject to federal income tax, but it is not subject to federal income tax withholding. The benefit value is subject to withholding for FICA taxes. The value of GTL, however, is not subject to FUTA tax.

HOW TO CALCULATE GROUP TERM LIFE

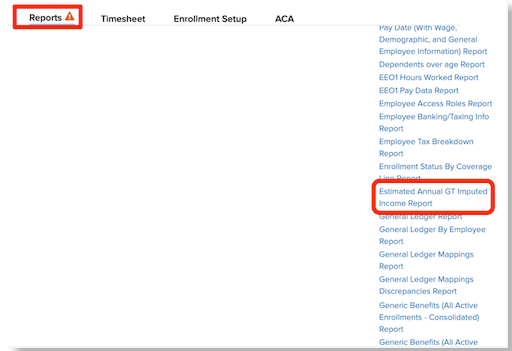

Run the Estimated Annual GT Imputed Income Report by going to Namely Payroll > Reports > Date Range > choose the preferred time frame > Apply Custom > Estimated Annual GT Imputed Income Report (under the Microsoft Excel Reports column).

-

This report calculates both a Per Pay (the amount found in the column titled Actual Imputed Income Per Pay Period) and an Annual Amount of Imputed Income (the amount found in the column titled Report Imputed Income).

-

This report will only work if you have the Group Term Life benefit configured (otherwise you will need to manually calculate.)

-

The Group Term Life calculator is attached to the report for manual calculations. The group term life calculator does not come included with the Estimated annual GT Imputed income report

Impute Per Pay Period

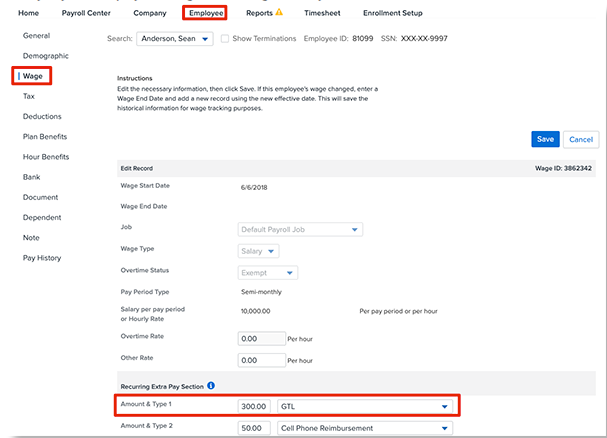

If you choose the Per Pay Amount, you can enter that in the Recurring earnings section of the employee's Wage record.

Go to Namely Payroll > Employee > Wage > Recurring Extra Pay > choose GTL in the drop down selection > add amount.

-

If you need to mass update, you will be required to include all (current and updated) Recurring Earnings on the Import File.

-

If you already have all three Recurring Earnings used, you will have to manually import a file with the fourth Recurring Earning directly into the payroll each period by uploading your additional pay file. Refer to this article Uploading Additional Pay for step-by-step instructions.

Impute Annually

If you choose to do a one-time Additional Pay upload of the Annual GTL amount into the payroll at the end of the year, you will have to manually import a file with the Additional Earning directly into the payroll cycle. Refer to the article Uploading Additional Pay for step-by-step instructions.

If you want to report Uncollected Social Security and Medicare amounts for the imputed portion of GTL (typical for terminated employees), please follow the procedure in the article Processing GTL Amounts for Terminated Employees.